CX360 - Specialized banking CRM Software

Foster relationships with your clients

while we take care of the technology

CX360 is a specialized banking CRM software that enables your bank to manage relationships with clients

It helps you optimize your resources and increase profits by becoming more efficient and agile. With CX360, your bank is on a good path to provide exceptional

customer experience.

is what makes exceptional banks.

Experience with CX360 is constantly improving as we adapt the solution to new trends and customer expectations

CX360 is a specialized banking CRM software that enables your bank to manage relationships with clients

It helps you optimize your resources and increase profits by becoming more efficient and agile. With CX360, your bank is on a good path to provide exceptional customer experience.

is what makes exceptional banks.

Experience with CX360 is constantly improving as we adapt the solution to new trends and customer expectations

Personalized CRM for Your Bank

Instead of getting a CRM that only partly responds to the needs of your departments, work with us to cover 100% of your processes.

Key benefits

of client data

for supervisors

for clients

higher efficiency

omni-channel experience

Modular solution – build

your own CRM

Key benefits

of client data

for supervisors

for clients

higher efficiency

omni-channel experience

Modular solution – build

your own CRM

Loan Tracking System helps us track portfolio and respond to market changes efficiently.

It changed our internal communication for better and helped us integrate all of the client data into one system, presented via the 360 Client View.

Marija Glišić

Head of early collection

Naša AIK Banka (ex Sberbank Serbia)

Loan Tracking System helps us track portfolio and respond to market changes efficiently.

It changed our internal communication for better and helped us integrate all of the client data into one system, presented via the 360 Client View.

Head of early collection Naša AIK Banka (ex Sberbank Serbia)

CX360 vs Similar products

Type of solution

- Use case

- Technical deployment

- Pricing structure

- Customer support

- Role administration

- Interface

- Onboarding

- Integration with other apps

- Additional support

-

Custom made for banks &

financial institutions

- On-premise & cloud

- Transparent

- Agile support guaranteed by SLA*

- Defined by the bank

- Intuitive

- Demo and personalized trainings

- Yes

- Consulting on efficient business processes

Similar products

- Modified for banks

- Cloud only

- Complex

- Little to no support

- Limited customization

- Intuituve

- Demo

- Yes

- Not defined

Modules

Loan Tracking System is a module for debt collection, covering all aspects of early and late collection processes.

Sales Opportunities module is made for a modern approach in sales processes that heavily relies on personalization.It is designed to empower your team with detailed information for proactive approach in contacting leads or existing clients.

The Complaint Manager module ensures each complaint your bank receives is passed on to the right employee. Cross-sector collaboration is also possible on issues that require employees from several sectors to work together in order to provide the solution.

With KYC/AML Task Manager, your financial institution will always have the most up to date client documents. Whether it is ID or any other piece of information relevant to you, KYC/AML Task Manager can create automated tasks for employees or groups of employees to follow up and check in with the client.mplaint Manager module ensures each complaint your bank receives is passed on to the right employee. Cross-sector collaboration is also possible on issues that require employees from several sectors to work together in order to provide the solution.

Client On-boarding module provides the entire set of tools needed for account registration, even remotely. This module can be integrated with e-signature certificates and video calls for maximum security.

Product catalog lists all of your products in one place. With this module you can create a set of procedures and automated approval rules for any business process.

Point of Sale loans is a CX360 module for installment loans issued through partner companies. Customers can shop for goods and services on the spot, getting access to installment loans and a quick approval system.

Sales and Marketing teams can execute hyper-personalized campaigns based on segmentation. This CX360 module connects with other systems to support creation and management of campaigns via various channels (SMS, Digital Channels, Contact Center, Branches). Teams can then measure the success of campaigns via dedicated reports.

Our success stories

We developed lasting relationships with our clients. In order to understand why banks choose CX360, read our case studies in detail here.

Naša AIK bank

In 2018 Logate started implementing Loan Tracking System, CX360 module for debt collection, for Sberbank Serbia. The implementation resulted in high efficiency of the Early Collection department of the bank, helping employees make more calls and send more messages to clients while reducing time spent on redundant tasks.

NLB Bank

NLB Podgorica, member of the Slovenian NLB group, was looking for a solution that would enable their Sales department to track all of their sales processes, interactions with clients and schedule actions and reminders such as calling the client, scheduling appointments and more. Furthermore, their Sales team leaders needed to be able to follow leads through the sales funnel and have an overview of the team’s performance and identify top sellers.

Download CX360 whitepaper

with detalied overview of modules.

Download CX360 whitepaper

with detalied overview of modules.

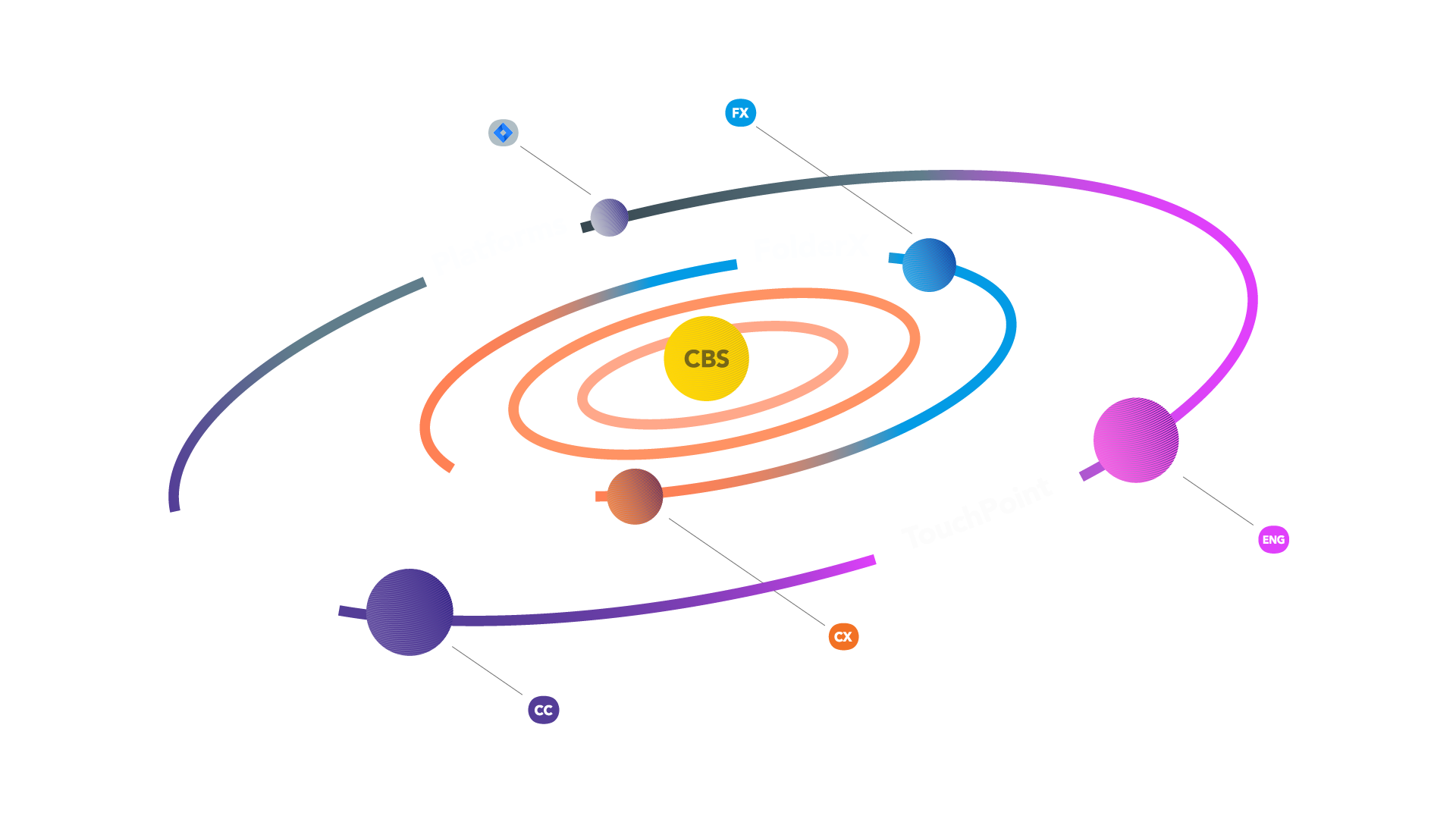

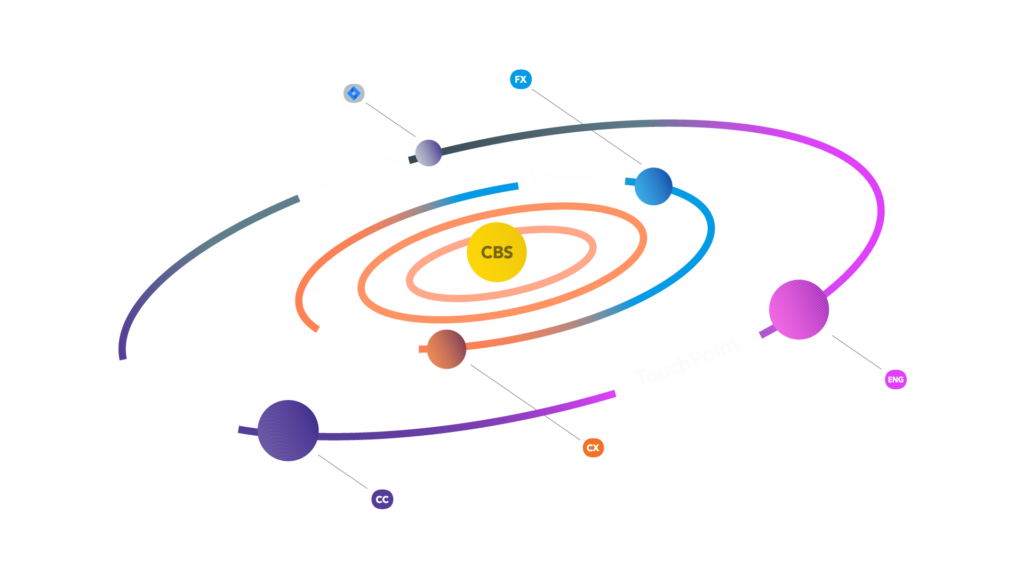

Digital Banking Universe is a set of products designed to take digital banking to the next level.

Connect Omni-channel Contact Center solution combines all of your communication channels (calls, video call, social media pages, chats) into a single agent interface.

With intuitive interface, automated reporting and advanced KPI tracking, its is supporting your team in providing excellent customer service.

TouchPoint Bull Messaging System ensures your customers see transactional, promotional and conversational messages your bank is sending.

You can send bulk messages via SMS, Viber and in app/web app notifications.

FolderX Entreprise Content Management System helps you manage and track internal and external documentation.

Repetetive business processses can be automated for efficenty with FolderX – your own digital office.

Digital Banking Universe is a set of solutions designed to take digital banking to the next level.

Connect Omni-channel Contact Center solution combines all of your communication channels (calls, video call, social media pages, chats) into a single agent interface.

With intuitive interface, automated reporting and advanced KPI tracking, its is supporting your team in providing excellent customer service.

TouchPoint Bull Messaging System ensures your customers see transactional, promotional and conversational messages your bank is sending.

You can send bulk messages via SMS, Viber and in app/web app notifications.

FolderX Entreprise Content Management System helps you manage and track internal and external documentation.

Repetetive business processses can be automated for efficenty with FolderX – your own digital office.

FAQ

Yes, CX360 is a CRM that integrates with your core banking system, either through web services (real-time integration) or via .CSV files (1-day delay in receiving data from the core). Other integration points are optional, depending on which other systems the bank uses. Most common integration is with contact center software.

Integration with the core banking system is the most common way of implementing our CRM in your existing IT infrastructure. However, in some banks we integrated CX360 with the data warehouse.

No, CX360 is a modular solution. We charge implementation and license fees per module. The only pre-requirement is established integration between CX360 and your core banking system or data warehouse (360 View). For example, if your bank wants to implement only the Sales Opportunities module for your Sales department, you will only need to cover the costs of integration with the core (360 View) and the implementation of the Sales opportunities module.

Absolutely! CX360 modules adapt to your department’s business practices. Your Collection department may only use calls for contacting clients and wants to have employees reminded every 14 days to follow up with the client whereas another bank may use calls and messages and wants reminders every 30 days.

CX360 can be deployed as a cloud or on-premise solution. In both cases, the solution is highly customizable and open to integration points with other systems your bank uses.

Yes! We can integrate with your mail server and other communication systems in order to make the process of reaching clients easier. Every interaction is stored and can be accessed via the Communication History tab under the 360 Client View.

Implementation time varies and depends on the number of bank employees that will have access to the CRM features, which modules are to be implemented and what are the necessary integration points.

Once you decide to implement CX360, our team needs to sit down with your IT department, as well as with a representative of the department which will be using the CX360 module we are discussing. The workshop is organized in order to write down all the workflows the department needs, including the necessary integration points. After the workshop our team will send in the offer along with proposed implementation times.

CX360 has been implemented in the following banks to date: Naša AIK Banka, Erste Montenegro, NLB Podgorica, CKB member of OTP group, Hipotekarna bank, Lovćen bank, Prva banka.

Please fill out the form on this link and we will get back to you with proposed times for the demo call. During the demo call we would like to get to know you and your goals in order to showcase the most relevant features of the CRM. The approximate call duration is 45 minutes.

Sign up for our monthly newsletter

We only share good stuff.