Recently adopted PSD2 directive in Montenegro has opened a whole world of possibilities for banks and fintechs. I sat down with Olga Levandovska, Solution Manager for Open Banking & Open Finance at GD Next and Alessandro Vilardi, EMEA & Asia Digital Solution Director at CRIF. These two companies formed partnership for bringing their expertise and solutions to different markets.

Open Banking Introduces New Competitors to the Market

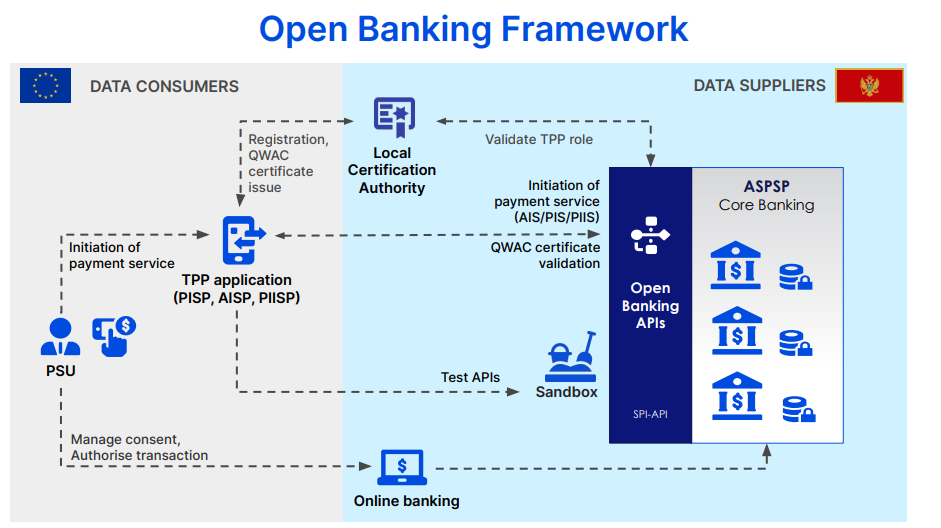

PSD2 directive was introduced to increase transparency and level the playing field within the financial services industry. Account aggregation is just the first step that allows for initiation of payments, introducing new players to the market. Furthermore, open finance integrates financial services outside the core financial services industry, into Retail and other industries.

National Authority (in most cases central banks) issue standards that banks must follow in order to comply with PSD2 directive. API management is one of the key processes, as well as the Strong Customer Authentication (SCA).

Implementation models vary by market and they can be:

- Individual – premium APIs, more security, less external dependencies but also higher TPP onboarding costs, higher operational costs and slower updates

- Service model – faster implementation, quick updates, shared operational costs but also no direct API monitoring and higher dependency on common extended Premium APIs and additional costs for customization

Open Banking Helps Mitigate Risks

CRIF provides solutions for credit scoring and open banking is another data source for them. Even raw data coming from other banks can be significant. Once analytics and KPIs are built upon the raw data, banks and fintechs can benefit from insightful information about the customer. Credit scoring and decision making can be significantly improved, mitigating risks for the bank.

Another benefit of open banking also can make customer onboarding seamless and improve processes for uploading documentation.

Resources

Download the open banking presentation here.

For more information about GD Next and their open banking suite, please visit gdnext.com

For more information about CRIF and their open banking and credit scoring solutions, please visit crif.com