Recap of episode 5 of Bank on Digital in which we discussed latest threats banks are facing when it comes to KYC, including deepfakes and elaborate frauds. Pablo Amilibia, EMEA Partnerships Manager, from our partner Veridas explained how their technologies for biometrics authentication and digital identity that act as a firewall for all known identity schemes.

Veridas works with clients, such as BBVA banking group, Deutsche Telekom, Cabify and many more to provide secure digital and physical ID checks.

You can watch Bank on Digital webinars on demand on YouTube or listen to the episodes on Spotify.

KYC Case - 10% Sample of Banking Clients Were Fraudsters

KYC (Know Your Customer) is a key aspect in banking. It is a part of anti-money laundering (AML) policies and a legal requirement for banks. KYC is a starting point for digital onboarding and, therefore, plays an essential role in protecting clients and the bank against frauds.

In 2018, Veridas ran a check for a bank that is their client and found that 1,000 out of 10,000 clients of the bank were using duplicate identities, using fake government-issued documents. The technology enabled Veridas to detect all of the duplicate identities, even if the person changed a picture on the document.

How Veridas Prevents Identity Frauds

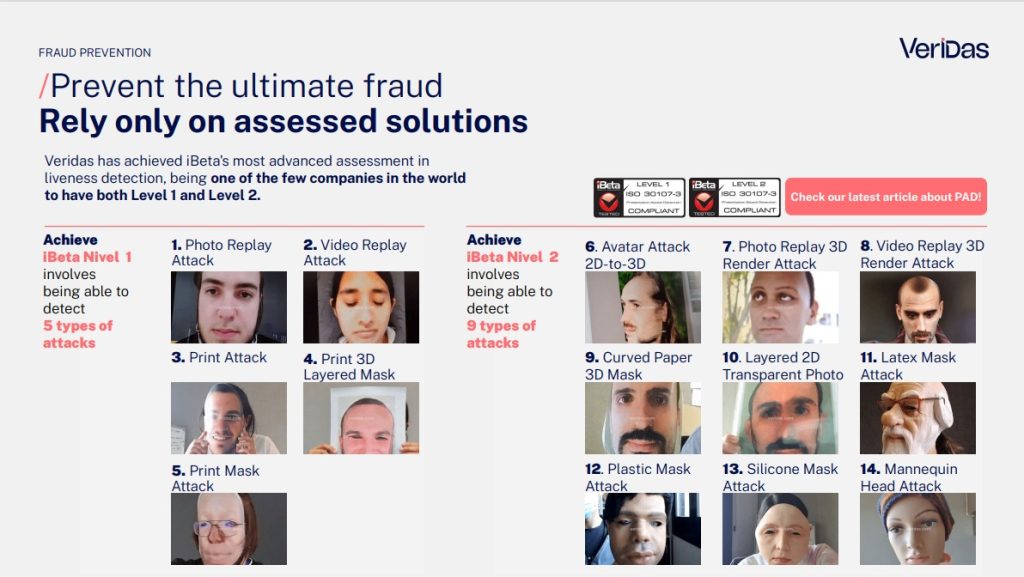

Over the years, fraudsters have found ways to use emerging technologies to their advantage. Such an example is artificial intelligence and its application in deepfake videos. This is how Veridas combats all levels of fraud and why they are Logate’s chosen partner for identity verification.

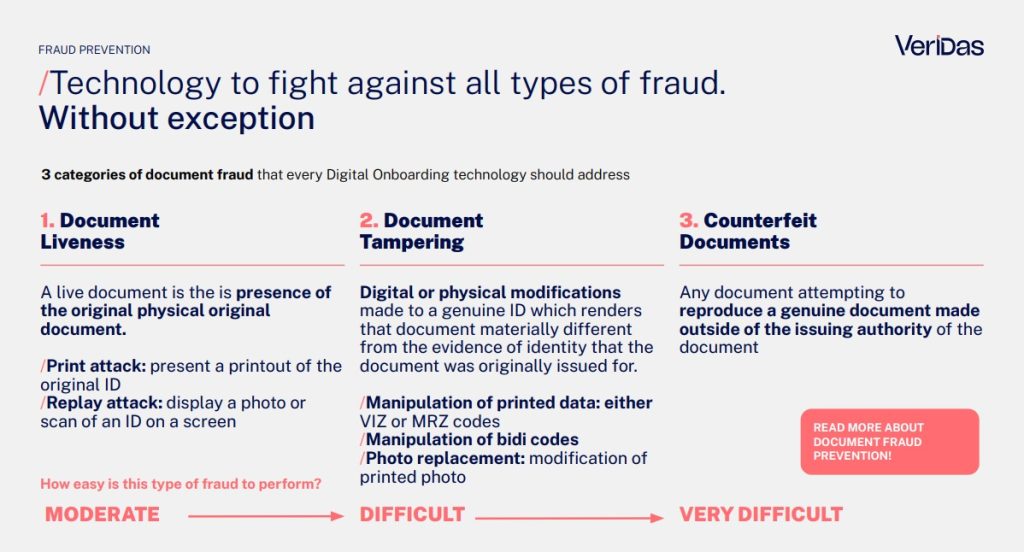

1. Document Printouts

The fraudster presents a copy of the original document. Such an example can be a scanned copy or a photo capture of the original document. Veridas checks the liveness of the document, ensuring it is indeed an original document. Veridas supports all known languages, as well as all kinds of alphabets.

2. Document Tampering

A more advanced type of fraud occurs when the fraudster uses the digital or physical ID with certain modifications (for example, photo and date of birth are changed). This document cannot pass the check either, as the analysis that Veridas does is contextual, meaning that all of the elements must correlate in order for the document to be marked as valid.

3. Counterfeit Documents

These documents are made to not only appear legit but they can sometimes even be printed on the official devices. However, they contain unique NFC chips that are also analyzed by Veridas.

Video Liveness Detection

Deepfake videos have become dangerous to banks. All kinds of deepfake frauds can be detected by Veridas. Even the most sophisticated deepfake videos are injected into the system and the liveness check helps Veridas assess whether the video is real or not based on certain criteria.

How We Streamline Digital Onboarding and Client Communication

Veridas and Logate work together to streamline the entire onboarding process for the bank and ensure that each client interaction in the future is completely safe on both ends.

Connect, Logate’s omnichannel contact center software, supports electronic and OTP authentication. The third type of authentication will be powered by Veridas and it will ensure that the bank communicates with the right person each time, working in the backend and analyzing provided documents and video of the person on the other end of the call.

Are you expecting PSD2 implementation in your country soon? Contact us and find out how we can streamline the entire process of digital onboarding for you.