At the Technobank 2022, Logate team was invited by the ASB (Association of Banks of Serbia) to deliver a presentation together with Naša AIK Bank at the spring counseling in Vrnjačka Banja on May 13th.

BankInfo is a biannual educational event ASB organizes in order to support banking professional and overall development of banking industry in Serbia. However, this time we were able to interact with bankers from Bosnia & Herzegovina and Austria as well who had also come to benefit from educational and networking aspects of the event.

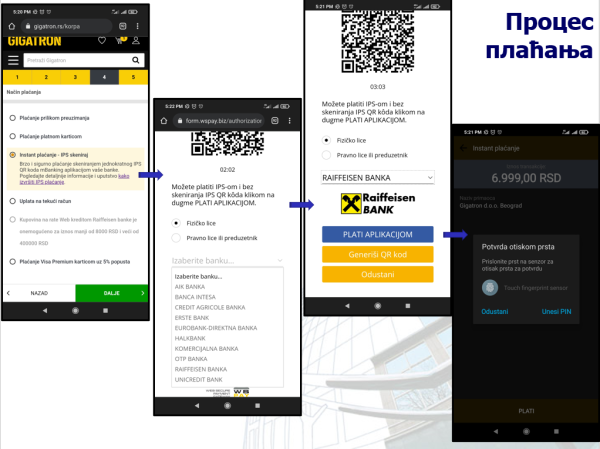

Deep-link Instant Payments Are Available

Central Bank of Serbia started off the event strong with their presentation on deep linking technologies and its use in instant payments. Recognizing the massive growth of mobile banking and global trends, regulations were put in place to enable instant payments online. In practice, instant payments can be facilitated via QR codes or links. In the final phase, fingerprint confirmations are required to verify identity and avoid repeateadly having to enter card details.

Banka Intesa Introduced Fiscal Devices

Last year, new law on fiscalization had been implemented in Serbia. Digitalization of the tax system revolutionized the way merchants do invoices and banks wanted to support them. Banka Intesa responded by building their own Android POS fiscal device, in cooperation with telco providers Galeb, Yettel and A1. This is an excellent example of how banks respond to trends and regulations in support of businesses.

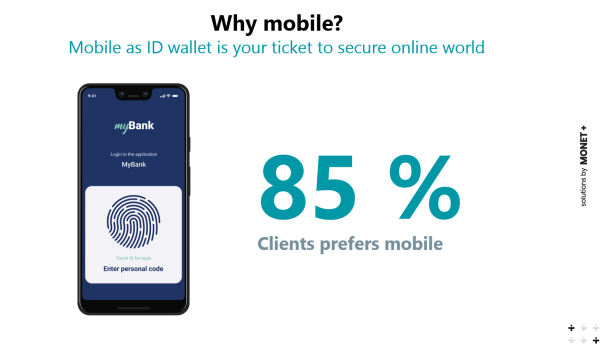

Future is Mobile (ID)

MONET+, Czech software company, presented their solutions for digital identity. As they said, “digitalization and digital identity are not just a wave, it is the way the whole world is heading”. However, there are many challenges, including costs, changing user expectations and competition. Something we have been stressing out to our bank clients is the importance of mobile and MONET+ confirms it, with 85% of customer prefering to use mobile as ID wallet with fingerprint verification. Mobile ID provides convenience as it acts as one ID for all online services. While this model is still not seen in Montenegro nor Serbia, Logate is prepared for the next wave of digitalization in the Balkans.

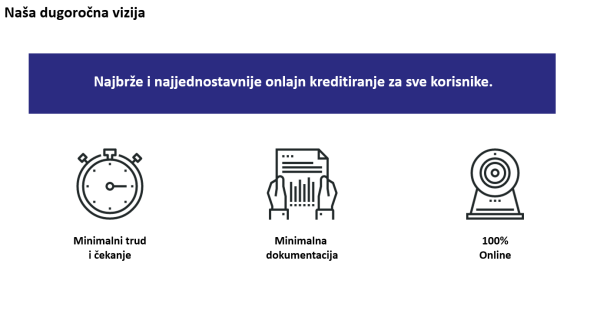

Loans Can Be Approved Online Within 30 Minutes

Digital loan origination is certainly not a revolutionary innovation but it’s still quite new in the Balkans. Raiffeisen bank is the pioneer in Serbia, with its iKeš (iCash) platform. In just 30 minutes, clients can apply for a loan and receive money instantly to their bank accounts. Recent regulation changes made it possible for Raiffeisen bank to offer this service in 2022. When their client applies for a loan (for up to 6,000 euros), the bank automatically checks income and offers video ID for the final steps of approval. There are anti-fraud mechanisms in place to protect the bank. Raiffeisen has ideas on how to further popularize this service, which includes raising the maximum loan amount to 10,000, self-service that doesn’t require agents to process identification and introduction of open banking. Hopefully, these are all innovations we will witness soon in the Balkans.

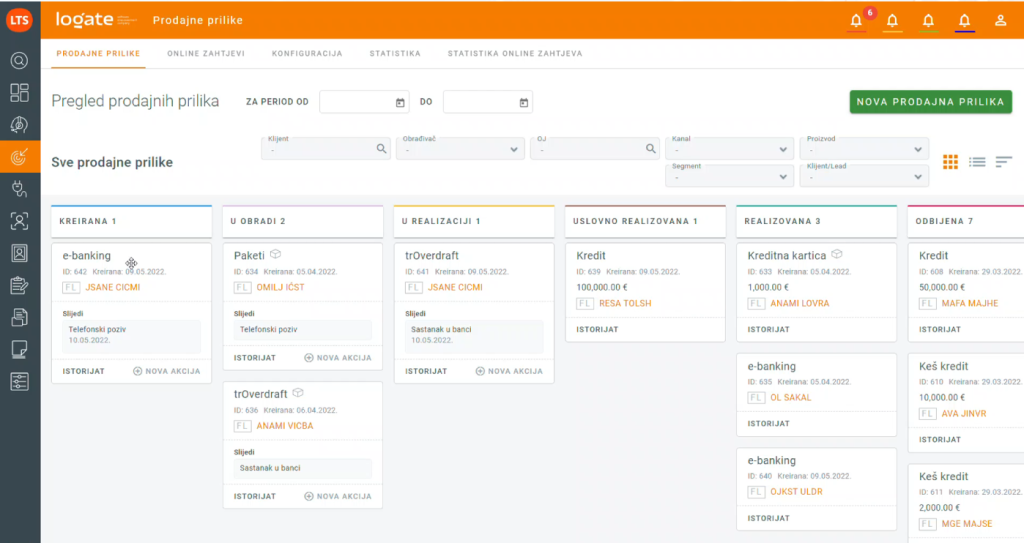

Marketing Personalization in Banking in 2022

Logate took the stage with Naša AIK Bank to talk about marketing personalization in banking industry. Powered by our experience implementing CX360 banking CRM in banks across the region and our colleagues’ hands-on knowledge in this field, we pointed out the aggressive “personalized” marketing strategies that backfire and presented the importance of true omni-channel approach in marketing. Bottom line – make sure you run camapigns across multiple channels but ensure that the channels are integrated! Our CX360 specialized banking CRM can help with personalization. Are you looking to improve marketing and sales efforts? Reach out and lets see how we can help your financial institution.

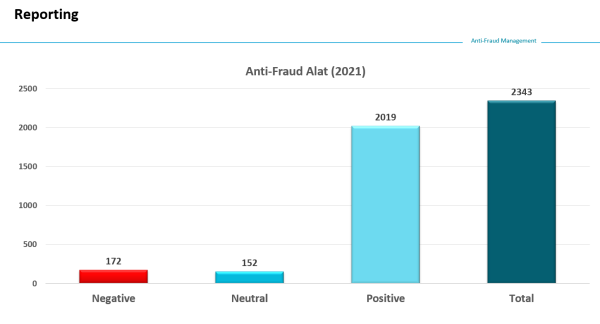

Anti-fraud Checks Should Be Automated

UniCredit Bank presented their automated processes for anti-fraud prevention. Through their UW Tool, UniCredit Bank matches personal information with corporate data and cumulatively scores the client. If the score is lower than the pre-defined number, bank employees are alerted. This functionality reminded us of the KYC/AML Task Manager module of CX360 which automatically assigns KYC and AML tasks to the relevant employees. A must have tool for protecting banks from potential frauds.

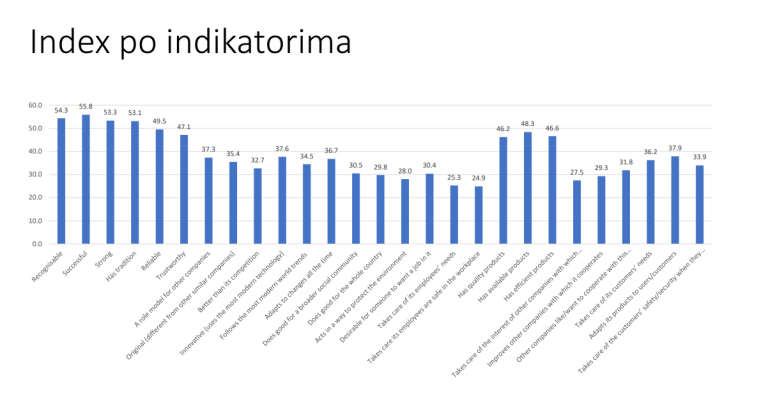

How To Measure Corporate Reputation

How do you measure corporate reputation index of a bank? Nina Media has a solution – Incore. Incore quantifies 9 dimensions of a corporate image, ranging from brand perception to social responsibility. With more than a decade of experience in media monitoring and marketing research, Ninamedia gave us a new perspective in understanding different factors that affect the way corporate companies position in the eyes of customers.

BankInfo - TEDx of Banking in Serbia

We were inspired, motivated and, best of all, we connected with professionals in the banking industry of Serbia, Bosnia & Herzegovina and Austria. BankInfo is not just a counseling event, it is a one of a kind TEDx of banking in Serbia and ASB does an amazing job putting it all together. We cannot wait for the next edition in September in one of the most beautiful locations in Serbia, Kopaonik mountain.