Technobank is the most significant fintech event in the Western Balkan region which has been gathering fintech companies and banks for over 20 years now. The conference, along with the exhibit, brings together about 500 attendees each year and is a birthplace to acquisitions of new technologies, new global partnerships and a platform for sharing innovative ideas and products that are disrupting the banking industry.

In case you did not attend the 22nd edition of the conference, here are some takeaways that banking professionals and executives should be aware of, as we’re entering the new era of finance.

1. E-commerce is growing rapidly and banks are prepared to support the growth

Unsurprisingly, e-commerce was a major topic at the conference. The pandemic forced the key players to conform to the newly developed habits of their clients that kept buying via e-commerce stores. The growth is not limited only to e-commerce stores and marketplaces but transcends to the more extensive usage of credit and debit cards, chatbots, delivery services, and more.

Ananas COO and acting CEO, Marko Carevic, said that although their marketplace which strives to position itself as the Serbian Amazon is growing in sales, the next big thing is fulfillment and the ability to schedule deliveries at different locations.

Zorana Brankovic, head of multichannel department at Banca Intesa Beograd, said that the bank is working to provide clients with one-time shareable payment links for direct payments to merchants and service providers, such as lawyers, notaries, etc. The National Bank of Serbia is also considering changing the regulations in order to allow payments in installments, which would act as instant mini-loans for online payments. Could this be the first big step towards modernizing the banking industry across the Balkans?

2. There is a huge demand for digital regional ecosystems

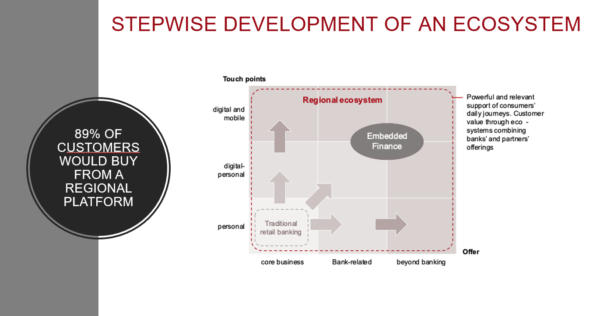

In his keynote presentation, Dr. Rainer Schamberger from Euroconsulting Group explained the model of a digital regional ecosystem with embedded finance. Dr. Schamberger has vast experience in banking, having worked at Sparkasse, Raiffeisen and Sberbank Europe, among many other renowned financial institutions.

There have been many talks of regional cooperation in recent years and Dr. Schamberger presents one potential model in the finance industry. One single digital ecosystem could unite smaller Balkan economies, accelerate innovations and drive growth in the financial sector. How do banks fit in? Banks are seen as a key player that supports the entire customer journey, rather than just the final step in which they make a purchase. Instead, customers today want an ecosystem that combines banks’ and partners’ offerings, selling a bundle of products and services within one platform. That’s where embedded finance comes into play. It is more than a buzzword and one of its usage examples includes BNPL (buy now, pay later concept).

A regional ecosystem like that might sound utopian but it exists in the Nordics, embodied in the Nordics P27 group which was formed by the leading banks in the Nordic region. Are we years behind or the pandemic pushed us in this direction? Dr. Schmaberger finished the presentation by saying that we cannot forget about the people and therefore, inspiring leaders are needed to make the regional ecosystem happen.

3. Employee experience matters just as much, if not more, than the customer experience

We innovate for the people. But people are also conducting and making those innovations happen. Whereas the concept of employee experience is certainly not new, our company Logate demonstrated its significance through our own experience in implementing specialized banking CRM in 11 banks across the region, but also based on modern studies conducted by leading business organizations.

Joined by our colleagues from Naša AIK Banka, Marija Glišić and Ivan Perić and in the TED talk style, Jevrosima Zogovic presented the painful reality for many banks – the employees using Excel to process client data and finish their daily tasks. In many banks Excel is just one of the tools and systems needed to complete a single task. When switching to a more sophisticated solution, such as our CX360, the management faces resistance from the employees.

In order to create a company culture that fosters tech adoption, there are 5 pre-requirements: 1) incentivizing technology use through rewards and gamified experience, 2) investing in infrastructure and systems, 3) making learning part of employee’s tasks, 4) making tech adoption part of a long-term strategy, and 5) explaining the benefits from the employee perspective, avoiding any talks of sales projections. Does your bank utilize these strategies in adopting new technologies?

4. End-to-end ATMs instead of branches?

The year is 2022… The pandemic has transformed the banking industry and forced many banks to reduce the number of their in-store branches. CNBC reported that US banks closed the record number of branches in 2021 and UK banks are following the trend with some of the banking giants announcing closures this year. NCR responded quickly by pushing their innovative ATMs to the market.

Anna Wasicka, global product marketing manager at NCR, presented about the company’s innovative ATMs that can fulfill the needs of clients. These ATMs aim to provide a frictionless experience with their intuitive design which is a problem for all the complex banking operations a client might need. However, NCR overcomes that with their design thinking process in which they center processes and technologies around the end user with the ability to cater to the bank’s specific needs and provide expertise and recommendations.

It seems like we will be seeing more sophisticated ATMs in the coming years with advanced functionalities, such as the one NCR is already developing further – segmentation which will provide personalized ATM experience to customers.

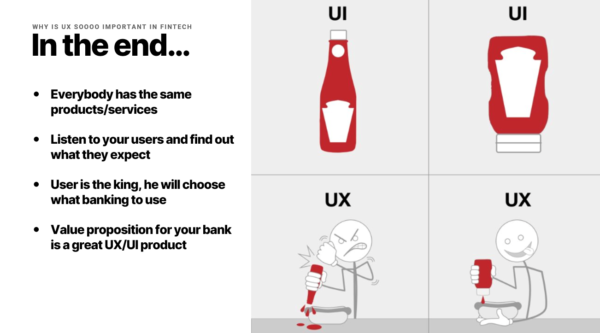

5. User experience is a USP that defines the market share

Jurica Vuković, from Euroart93 digital agency, came out on stage and dared to say – “Hey, we know your banks offer products but in reality, those products are the same”. The unique selling proposition, as he argued, is not in the products or their features which can be, with no doubt, innovative but also copied with more or less ease…but in the user experience they provide.

Banks, as some of their other clients, sometimes underestimate the importance of a good UI/UX design. Euroart93’s goal is to shift the scope of the project from “we” to “them” (their clients). Empathy plays a huge role in user experience design. Once the bank understands what are frustrations and pains of their clients, they can start designing a path to solutions, paved with their product features but always, always in a way that makes sense for the client.

Their presentation showed the current state of the industry, with examples of world renowned banking giants, such as Revolut. However, they also showed design concepts of what the next generation of banking could look like and probably got a lot of banking executives in the audience to take notes (or photos).

When you take a look at their portfolio of clients and their website, you realize that Euroart93 knows what they’re talking about. Rather than saying “our clients”, they say “relationships this intimate are illegal in some countries”. Does your bank dare to form relationships that intimate with your clients?

Technobank 2022 was a great networking event

The conference was certainly interesting but the greatest value to all of the participants was the networking that happened in the exhibition hall. With more than 30 exhibitors and over 500 attendees coming from all over Europe, the largest fintech event in the region provided a chance to discuss the innovations in the industry and plant seeds for potential partnerships that could disrupt the industry in the region and beyond.

We had many straightforward conversations with banking executives looking to implement a CRM solution and other products from our Digital Banking Universe. Hopefully, by Technobank 2023, we will have success stories and use cases featuring our newly acquired clients and partners that we met this year. Until then, we will continue with our efforts to help financial institutions become agile and respond to the needs of their clients.