You can watch Bank on Digital webinars on demand on YouTube or listen to the episodes on Spotify.

Banks Have a Competetive Edge Over Fintechs

We always talk about seamless customer experience so I was glad when Meaghan mentioned intended friction. With a plethora of banking services and products, such as Buy Now Pay Later, developed thanks to technological advances, we often overlook the rising number of threats lurking online. That being said, incumbent banks were challenged by neobanks and other non-banks which contributed to developing better customer experience.

Good customer experience is defined by Meaghan as personalized, intelligent, predictive, relevant and timely. There is a secret sauce for achieving all that – DATA. As Meaghan explains, incumbent banks are sitting on so much data. Data is every incumbent bank’s most powerful competitive edge over any fintech. If incumbent banks can set up a good organizational structure of data teams, innovative culture and replace legacy core banking systems with next-gen core, they have the potential to provide not only good but outstanding customer experience.

In the current market landscape, Chief Data Officers and data stewards will be highly sought in order to utilize big data.

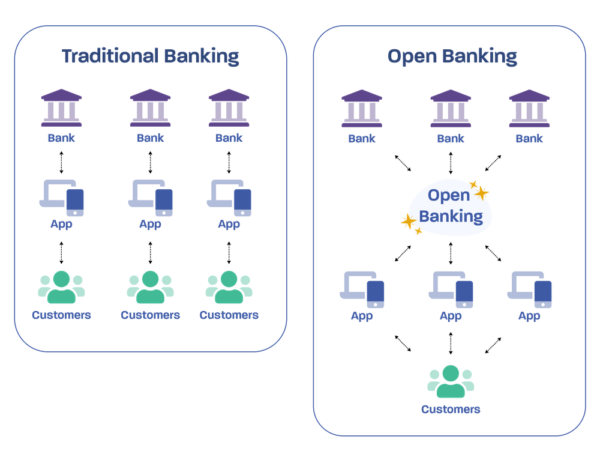

open banking vs Open Banking

Capitalized and uncapitalized use of the term open banking have different meanings. Uncapitalized open banking refers to banks opening APIs, whereas capitalized Open Banking is the UK and broader European regulation which primarily falls under PSD2.

Open banking looks a lot different in South East Asia. Leading banks there built API marketplaces where customers can find superapps and apps created by retail companies and other non-banking partners. In comparison, open banking in Europe mainly refers to account information access and payment initiation. End customers benefit from open banking as they save time and gain access to innovative and life-changing technologies.

Back in 2017, when open banking was first introduced by regulators in the UK, there were only a few examples of banks using third party APIs to provide better mortgage and lending experiences. Account aggregation and personal finance management were in the early development stage, whereas today they are widely used. Banks are nowadays using APIs to streamline the onboarding process and in the UK there are examples of banks building services to manage taxes and improve the lending process.

In order to onboard more end customers, banks need to educate customers on how safe open banking is and provide incentive, especially due to fears for data security.

Embedded Finance and BaaS - New Business Models for Banks?

As Meaghan says, embedded finance has become a buzzword in the banking industry. It is not a disruption, it has been around for years. One example is airlines embedding financial service products, such as credit cards through partnerships with banks. Embedded finance is applicable only to non-financial companies and banks can monetize it only as a partner by offering standard banking products and services in order to boost a company’s loyalty program.

Banks can revolutionize the world of finance by opening APIs and providing BaaS (Banking as a Service) that can fuel better customer experiences.

ChatGPT - Potential Disruption for Banks

AI technology may not be able to replace contact center agents but that may be the totally wrong direction to head into. With large quantities of customer data, banks may be able to utilize ChatGPT to help its customer-facing departments analyze data faster and identify new opportunities. It can act as an assistant for financial advisors to provide personalized advice and access to banking services that had only been available to VIP customers before.

ChatGPT should be used to automate mundane tasks in order to save us time and make us more productive but also give us time to focus on creative work. Parental advice is – do not fully rely on ChatGPT!

When it comes to technology taking our jobs, in banking it is the same as in any other industry – will the governments let society become unemployed. It remains to be seen but Meaghan and I do not see that scenario happening.

Have you picked up a thing or two from episode 2? New episodes premiere on a bi-weekly basis so make sure to subscribe below so we can notify about new episodes and send you member-exclusive resources.