You can watch Bank on Digital webinars on demand on YouTube or listen to the episodes on Spotify.

Digital Banking Looks Tremendously Different Across Different Markets

Different markets are in totally different development stages. For example, in some countries, non-banks are offering banking products and services, whereas the others are still waiting on the implementation of PSD2 regulation. When challengers entered the UK market, incumbent banks were already preparing for it, whereas the French market was barely addressing the challengers at the same time.

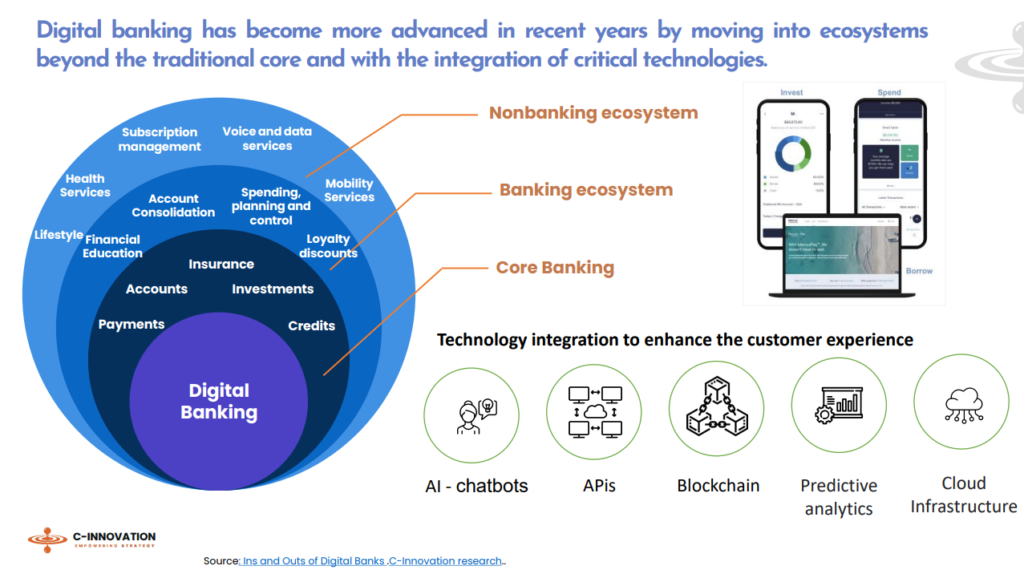

The COVID-19 accelerated innovations in the banking industry, with banks moving from core products (loans, payments, investments, accounts, insurance) to an entire banking ecosystem which entails account consolidation, financial education, budget control and loyalty programs. In most development markets we are seeing a brave move towards non-banking ecosystem as banks partner with healthcare providers, retailers and other companies to cover the needs of their clients.

Key Differences Between Incumbent and Challenger Banks

We are witnessing rapid growth and expansion of challenger banks that goes beyond payments. Many are slowly tapping into lending, investments and other core banking products. Their journeys have been entirely different, from the way they were founded to the way they operate.

For banks backed by corporates, the focus has always been profitability whereas challengers made it their mission to acquire as many users as possible in the shortest timeframe. They poured resources into brand building activities and mastering the way they service a specific niche. On the other side, incumbents have access to funds that challengers cannot compete with.

Banking, as one of the most regulated industries in the world, restricts challengers from getting a banking license in certain markets. That is where partnerships can be formed between challengers and incumbents in order to service an entirely new market segment, disrupt industries and provide exceptional innovations where everyone wins, especially the end customer.

Predictions for Banking in 2023

As we enter the second half of 2023, we can say with confidence that digital transformation is not a project but a continuous process.

With growth of AI tools, we are bound to see how banks will implement this technology in their operations. Virtual AI chatbots are just one of the use cases. AI technology can go beyond that, offering assistance in fraud detection and security. On top of that, we can expect to see banks experiment with AI in order to personalize product offerings.

Cross-sector partnerships will also be key success factors, as banks explore non-banking offerings. Thanks to open banking, banks can offer limited access to data and potentially build new BaaS offers, which will be of interest to non-banking players who have difficulties obtaining a banking license.

Subscribe to Bank on Digital

We won’t spam you, we’re here to provide value.